24.03.16 Finance Bill 2016 - Section 339A Expenses - Travel expenses of workers providing services through intermediaries

25 March 2016

25 March 2016

The long awaited confirmation of the legislation to enact the implementation of section 339A Income Tax (Earnings and Pensions) Act 2003 ('ITEPA') has been published today.

The legislation is little changed from the draft legislation with the exception of one main point; This concerns the inclusion of consideration of the Managed Service Company ('MSC') test in deciding if the supervision, direction and control ('SDC') test needs to be applied.

A summary of the legislation is as follows;

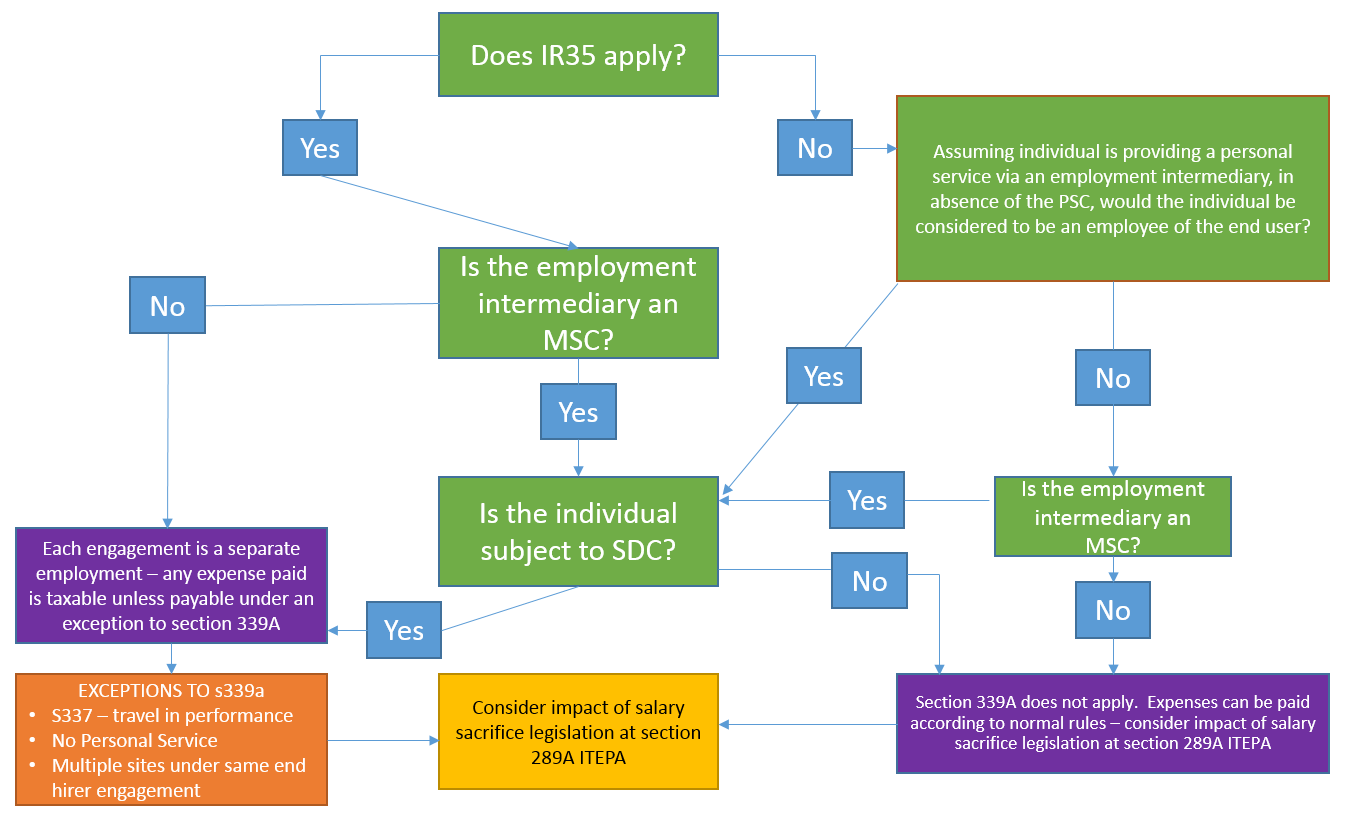

The following flow chart explains the situation in respect of PSCs:

Salary Sacrifice

Section 289A ITEPA directs that an expense paid via a relevant salary sacrifice arrangement does not qualify for tax exemption via section 289A ITEPA and so, must be subject to income tax.

The lack of corresponding National Insurance Contributions ('NIC') legislation led to mounting optimism that the deduction for NIC would remain. Unfortunately, such hopes have been dashed with the 11th hour implementation of The Social Security (Contributions)(Amendment) (No 2) Regulations 2016 which transfers the effect of section 289A in the taxes acts into the corresponding NIC legislation.

This means that a payment or reimbursement of travel expenses made via a relevant salary sacrifice arrangement must be subject to both income tax and NIC. Items which are exempt elsewhere in the taxes legislation (most notably mileage allowance payments) do not form part of general earnings or specific employment income to be subject to sacrifice and so, still qualify for income tax and NIC exemption.

View the Finance (No 2) Bill 2016 here and the Security (Contributions) (Amendment) (No. 2) Regulations 2016 here.

View Volume 1 of the Finance (No 2) Bill 2016 Explanatory Notes here and Volume 2 here.