Spring Statement consultation: Value Added Tax registration threshold – call for evidence

14 March 2018

14 March 2018

What is the Governments’ concern?

Government is concerned that the current design of the UK’s VAT threshold deters small businesses from growth opportunities and in this regard, has launched a consultation to understand the reasons why and how they can tackle this problem.

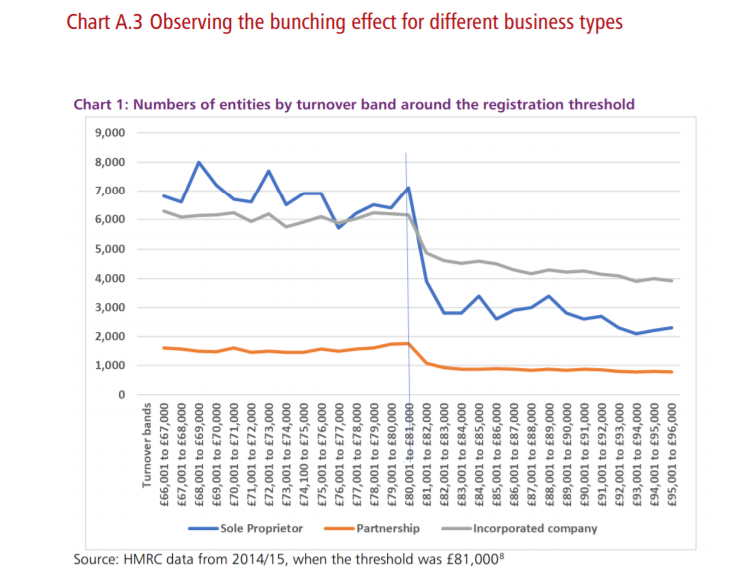

Recent evidence, which is summarised in the graph below, shows that there is a significant drop in the number of companies who turnover more than the VAT threshold creating a ‘cliff edge effect’. This suggests that businesses are actively avoiding breaching the threshold.

Why do many businesses want to stay under the threshold?

Currently, where the taxable turnover of a business exceeds the £85,000 threshold in a 12-month period, that business must register and account for VAT. Government believes that there are two main reasons why businesses stay below the VAT threshold.

Administrative burden of registration for VAT

Independent research has found that the additional administrative burden was the most feared drawback of registering for VAT for unregistered businesses. HMRC’s own data suggests that most of the administration is connected with the submission of VAT Returns. The Federation for Small Businesses believe this is due to the difficulty of correctly calculating the correct amount of tax owed.

The administration process is also further complicated as there are three different rates of VAT: Standard, reduced and zero, as well as some activities being exempt from VAT. However, currently the government’s ability to amend VAT law is restricted as the U.K. is currently part of European Union and EU law takes overrides U.K law.

Simplification measures already exist to reduce the administration burden on businesses once they breach the threshold including:

Government have suggested that Making Tax Digital (MTD), which is mandatory for VAT from April 2019 will simplify the process as businesses will have to use MTD compliant software. The software will connect directly to HMRC reducing the margin for error.

Financial cost of VAT registration

When a business registers for VAT they must start charging VAT to customers. The current standard rate of VAT is 20%. If the business sells to a consumer (B2C) and the business is registered for VAT, they have to either increase their prices by or absorb the additional cost of VAT as the consumer pays a VAT inclusive price. Therefore, unregistered businesses are at an advantage to registered businesses as they can offer more competitive prices to consumer.

Businesses which also have limited input VAT to recover, such as businesses which predominately supply labour, will also typically keep their turnover below the threshold as they do not buy items where they could reduce their price by recovering VAT.

Possible Solutions?

The Treasury is considering the approach suggested by the EU which introduces a smoothing mechanism which would allow businesses to exceed the threshold by 50% for a single year without registering. If the business exceeds the 50% cushion or the threshold for over 12 months the business must register.

In December 2016, Chancellor Phillip Hammond asked OTS to examine the impact of the VAT threshold and suggests possible solutions to the bunching effect. The OTS have suggested several methods ease the burden on businesses:

Consultation Details

There are 22 questions that the Government is requesting a response to. To see the questions and consultation in full details click here. The closing date for response is 8th June 2018. Government will then publish a summary of responses and draft legislation later this year.

Aspire Comment

Given the administration and financial impact VAT poses to many small business, any changes which reduce these burdens are a welcome announcement. It will be interesting to see what changes are made to the system in the context of Brexit given the current restrictions the EU has on the UK VAT system

In our opinion, it is crucial that any such changes are simple for business people to understand and operate.