HMRC as a preferential creditor

02 December 2020

02 December 2020

The Government announced in the Budget 2018 that it will be seeking to protect taxes withheld by a company or an individual going through an insolvency process.

Legislation was enacted in Finance Bill 2020 and the Government published their Policy Paper on the 30th November 2020.

As it currently stands, where a company or an individual becomes insolvent, the taxes paid by employees and customers , which the insolvent business was temporarily holding do not always go to funding public services as intended. Instead, they go towards paying off debts owed to other creditors and not HMRC.

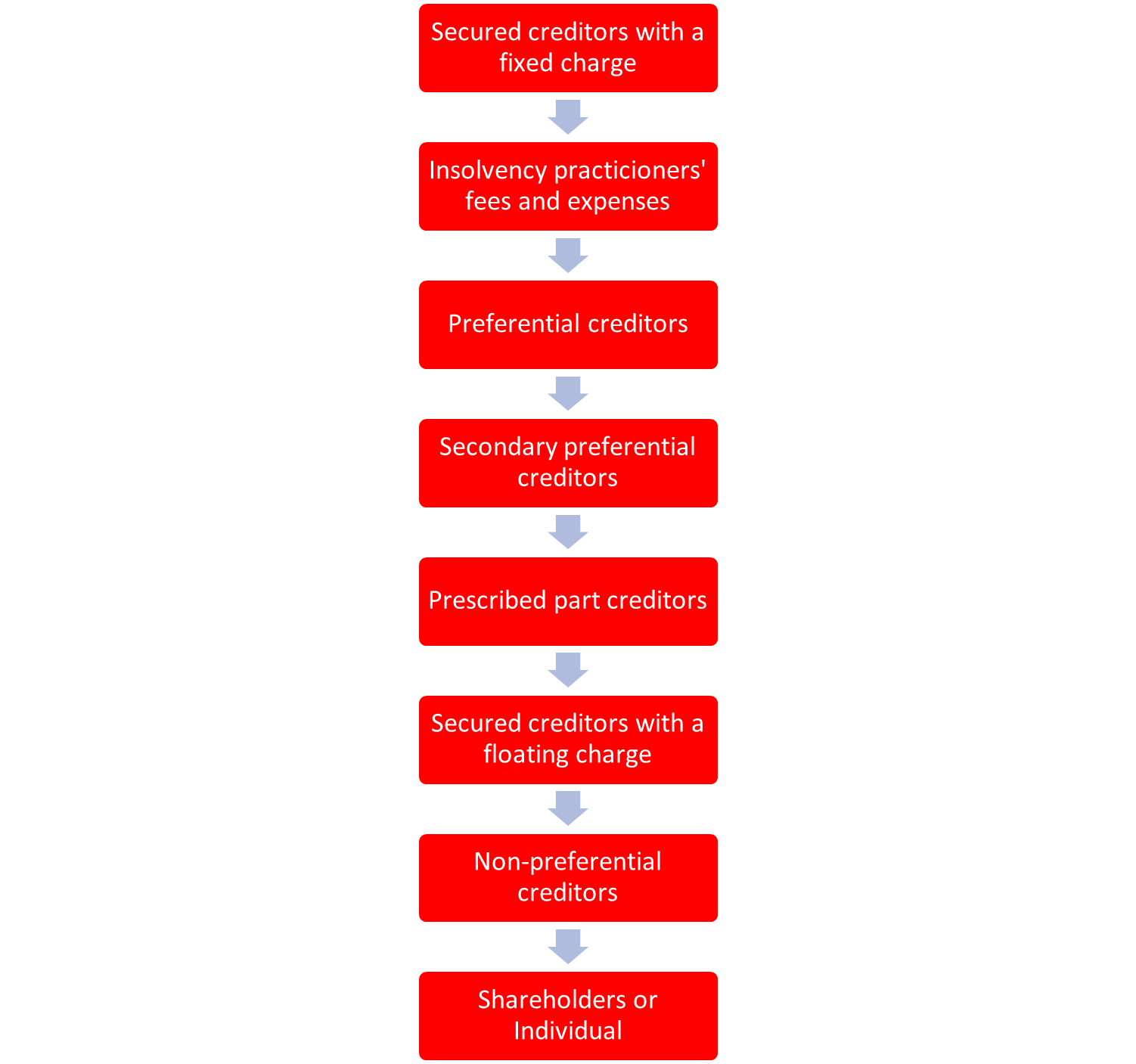

In all formal insolvencies a licensed insolvency practitioner must be appointed. Insolvency practitioners have statutory obligations to realise the assets of the insolvent business and pay those realisations to creditors in an order set out in legislation:

What’s changed?

For insolvency procedures starting after 1st December 2020, certain sums due to HMRC will rank as secondary preferential debts in the order of priority.

This will apply to certain types of taxes such as PAYE, NIC, VAT and CIS.

Unpaid sums due to employees rank as preferential creditors in the order of priority and this will not change – HMRC’s secondary preferential claims are paid after these preferential amounts are paid to employees.

Aspire Comment

As HMRC can typically be one of the largest creditors in the chain, being a ‘preferential secondary creditor’ means that they will now use up more of the funds that would have been typically distributed amongst unsecured creditors. Therefore, protecting HMRC but increasing financial implications on some businesses within the supply chain.