2016 - The Operation of the Construction Industry Scheme

06 September 2016

06 September 2016

Rhian Lloyd, Employment Tax and HR Manager at Aspire Business Partnership LLP, explains the operation of the Construction Industry Scheme (‘CIS’) in the context of who should be registered as a contractor and submitting monthly CIS returns and the consequences of not doing so!

We are seeing more and more HM Revenue and Customs (‘HMRC’) inspections in relation to the CIS - they seem to be exploiting the mass confusion in the recruitment industry on how this scheme operates. Coupled with CIS investigations, we are also seeing a number of businesses receiving letters from the Construction Industry Training Board (‘CITB’) asking them to submit a Levy Return or being issued with an estimated Levy Assessment.

Should I be registered as a contractor, subcontractor or both?

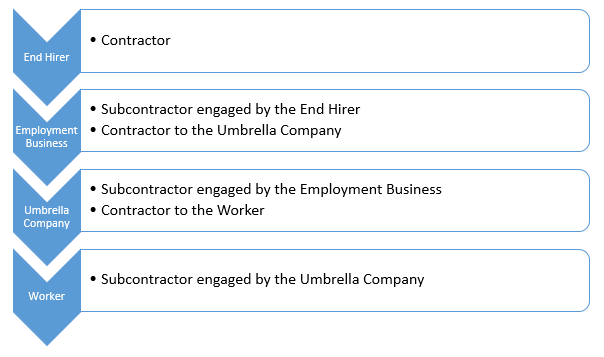

Employment businesses and umbrella companies forget that, in many instances, they should be registered as both a contractor and a subcontractor under the CIS. This is on the basis that these businesses are acting as a subcontractor when they are paid by other businesses to do construction work i.e. provide construction services/labour. However, these businesses often forget that they also act as a contractor because they source labour down the supply chain and pay other subcontractors for construction work. Please see the chart below for an explanation;

Contractor Responsibilities

It is important that you register as a contractor, where appropriate. Contractors must make the appropriate CIS deductions from subcontractors and submit monthly returns to HMRC as well as a payment for the deductions made from subcontractors.

A contractor should be verifying all subcontractors (including limited companies, umbrella companies and Personal Service companies) and making and reporting the relevant deductions dependent on the subcontractor being net or gross status. Alternatively, the subcontractor may not be CIS registered however this does not negate the fact that their services provided may be construction operations and so, subject to CIS deductions – in this scenario you should deduct 30% until the subcontractor becomes CIS registered.

If CIS deductions are appropriate but have not been made, HMRC may raise determinations under Regulation 13 of the Income Tax (Construction Industry Scheme) Regulations 2005. HMRC would direct you to make good the under-deductions of CIS in accordance with Section 61 of the Finance Act 2004 and pay over those deductions to HMRC under Regulation 7 (1) of the Income Tax (Construction Industry Scheme) Regulations 2005.

CIS Legislation – Mitigate a Liability

If you have made the mistake of not registering as a contractor under the CIS then all is not lost. However, you will need to take plenty of care in building a case up under Regulation 9 of the Income Tax (Construction Industry Scheme) Regulations 2005 in a bid to get relief. Regulation 9 (5) enables an officer of HMRC to direct that the contractor is not liable to pay if the conditions described in Regulation 9(3) or 9(4) apply.

Regulation 9(3) applies where a contractor fails to make a deduction from a subcontractor, but can satisfy an Officer of HMRC that the failure to make a deduction arose from an 'error made in good faith' or a 'genuine belief' that the payment was not within the scope of CIS and that he took reasonable care to comply.

Regulation 9(4) applies if the subcontractor, from whom the contractor failed to make a deduction, was not liable to tax on the payment, or has made a return of their income and profits in which the payment(s) made by the contractor were taken into account and the subcontractor has paid the income tax and Class 4 NIC, or corporation tax due in respect of such income or profits.

Aspire can help

If you read this article and believe that you may have an issue or have a query in relation to the CIS or CITB, then please don’t hesitate to call one of the Aspire team on 0121 445 6178.