2016 - PSC – Is it a MSC or Caught by IR35?

20 December 2016

20 December 2016

Jack Bonehill, Tax Consultant at Aspire Business Partnership LLP, blogs on when a personal service company (‘PSC’) is identified as a Managed Service Company (‘MSC’) or is caught by the intermediaries legislation (IR35). A PSC, for the purpose of this blog, is a limited company whose only services consist of providing only one individual’s service, with this same individual as the sole director and shareholder of the company.

Both the MSC legislation and IR35 cause confusion. Is a company a MSC? Caught by IR35? Both? Neither? When I usually ask people this question, they will take a punt but would not be confident nor be able to give justification for their decision.

It is worth noting at this point that a PSC cannot be both a MSC and within IR35. Firstly, it must be considered whether the PSC is a MSC. Where a PSC is a MSC, all of the payments made must be subject to PAYE.

If the PSC is not a MSC, then it must be considered whether the engagement between the PSC and a client is within IR35. This is because the circumstances of one engagement could fall within IR35 and another outside of IR35. If the engagement is within, then the IR35 calculation will have to apply to all income from that engagement. If the engagement is outside, then no special calculation needs to be applied.

Both pieces of legislation have their complexities. A PSC considering whether IR35 applies needs to consider a hypothetical contract which would exist between themselves as the individual who owns the PSC and the client who the services are provided to outside of the PSC arrangement. Then, from this hypothetical contract, the PSC must decide whether the individual would be an employee of the client or whether they would be self-employed, should the PSC not exist.

I will give a simplified version of when a PSC is a MSC and when an engagement is within IR35. The conditions specified within this blog should not be taken as a substitute for professional advice.

MSC

There are four conditions, all of which must be met, for a PSC to be a MSC. So, to check if a PSC is a MSC, you should check to see if all of the following conditions are met;

Condition one: The PSC’s business consists wholly or mainly of providing of providing the services of an individual to other persons.

A PSC as defined in this blog will always meet this condition.

Condition two: The payments made, to the individual mentioned in condition one, are equal to the greater part of all the consideration (money) received by the PSC for the provision of the individual’s services.

The best way to understand this is through an example.

Suppose we have Company A who provides the services of an employee, John Smith who is an IT consultant, to Supermarket A. Supermarket A pays Company A £400 a week for John’s services.

If Company A pay John £300, then the company is keeping £100. The £300 is the greater part of the £400, as the other part is the remaining £100. Therefore, in this scenario, John is receiving the greater part of all consideration received by the company for his services, and therefore, the condition is met.

However, if Company A were to pay John £100, then he would be receiving the smaller part of the £400, as the remaining part is £300. This would mean that the condition is not met.

Condition three: The way in which the payments are made to the individual in condition two result in a greater net pay than if all of the payments made to the individual in condition two were employment income (i.e. all pay subject to PAYE).

Employment income would take into consideration certain eligible expenses (for example, travel expenses).

Generally, the way in which this condition would be met is if the individual receives dividends, which increase the individual’s net pay. This is because dividends attract a lower rate of income tax than employment income.

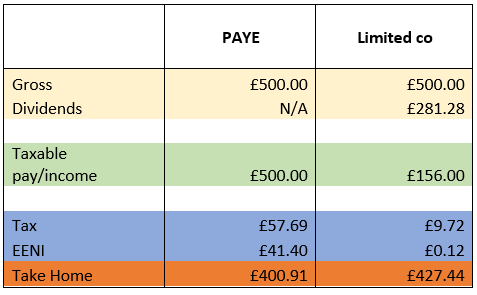

The example below shows when this condition would be met, because the take home pay is more when dividends are paid than when all pay is subject to PAYE.

This leaves two questions:Condition four: A managed service company (‘MSC’) provider is involved with the PSC.

These are explained below.

MSC provider: a person is a MSC provider if they carry on a business of promoting or facilitating the use of companies who provide the services of individuals. However, there are two exclusions:

This means that a person must do more than provide legal and accountancy services in a professional company, and must do more than supply the labour of individuals.

If it is decided that there is a MSC provider it is then necessary to consider if the MSC provider is involved with the PSC: a MSC provider is involved with the PSC if the MSC provider does any of the following:

As can be seen, these conditions for a MSC provider to be involved are very wide and broad. At the point there is a MSC provider, it is very difficult not to be involved.

IR35

If it is identified that the PSC is not a MSC it is then necessary to consider if the provision of the services is caught by IR35. A PSC is within IR35 if they are not a MSC, and:

The second bullet point here is tenuous one, as it requires a hypothetical contract to be constructed but also to have regard to the terms (contractual and non-contractual) under which the services are provided. The hypothetical contract is then looked at to see if it is one of employment or of self-employment. This would require a full status test as normal to determine the hypothetical employment statement of the individual.

From the second bullet point, it can be seen that IR35 must be considered on an engagement by engagement basis; this is contrary to a company being an MSC, which is considered on a tax-yearly basis.

Facts about IR35 and MSCs

I list some facts below that people don’t usually know or have a misconception about.

As can be seen by this blog, MSC legislation and IR35 are complex – the conditions aren’t clear and parts of it is down to interpretation. If you would like advice on the MSC legislation and IR35, then please get in contract with the Aspire team on 0121 445 6178 or enquire@aspirepartnership.co.uk.